tax deferred exchange definition

Production payments may be reserved by a lessor or carved out by the owner of the working interest. Section 1035 Exchange.

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

2 Interest on the amount of the deferred tax will be charged for the period that payment of the tax is deferred in other words from the due date for the payment of the tax determined without regard to the election to the date on which payment of such tax is received at the rate established under IRC.

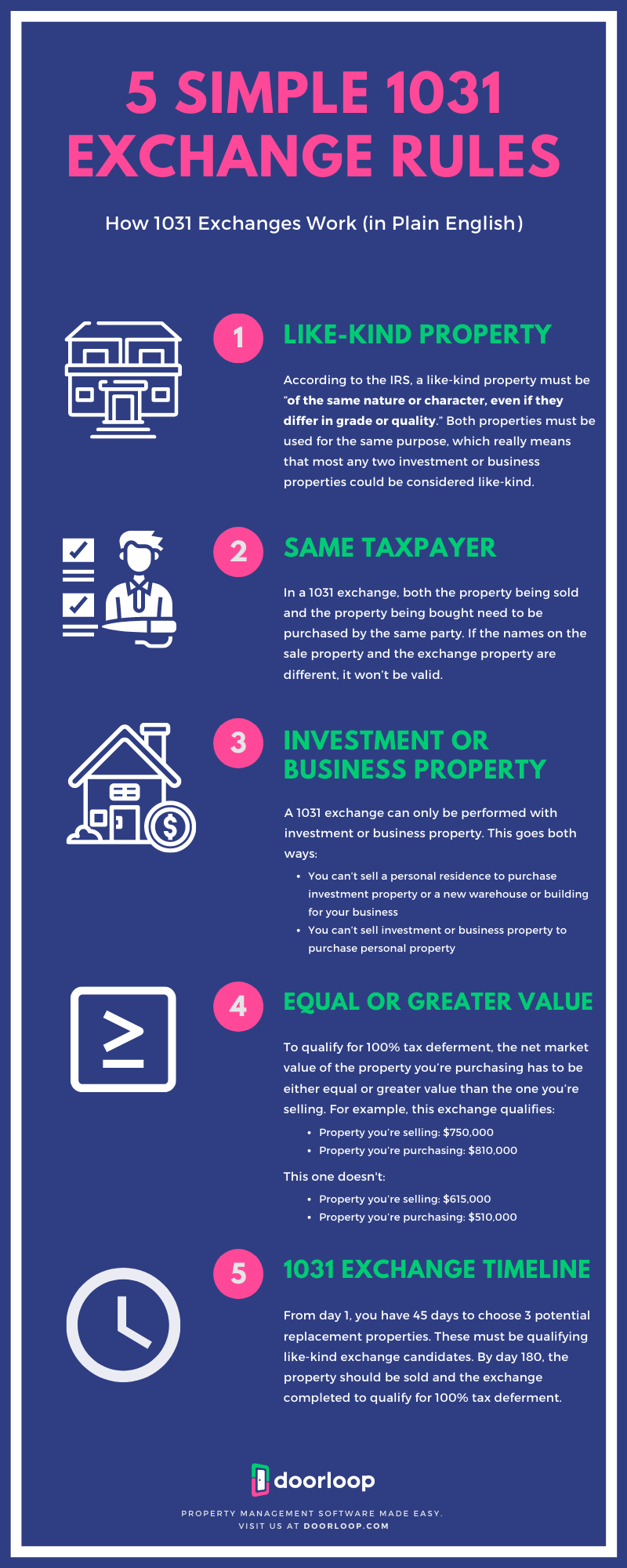

. 1636-3a1 and 2 and IRM 4411314 for further definition. 6621 that is applicable to. The final regulations which apply to like-kind exchanges beginning after December 2 2020 provide a definition of real property under section 1031 and address a taxpayers receipt of personal property that is incidental to real property the taxpayer receives in the exchange.

The definition of the time of supply for VAT purposes provides clarity as to when VAT should become due and payable. A sum levied on members of an organization to defray expenses. We welcome your comments about this publication and your suggestions for future editions.

2000-37 does not apply to replacement property held in a qualified exchange accommodation arrangement if the property is owned by a taxpayer within the 180-day period. The IRS will process your order for forms and publications as soon as possible. Like-kind exchanges using qualified exchange accommodation arrangements.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose allowing you to defer capital. Ordering tax forms instructions and publications.

When you file your federal income tax return for that year you must report the gain on Form 8949 and must reflect the change to your QOF investment on the Form 8997. A deferred tax liability is an account on a companys balance sheet that is a result of temporary differences between the companys accounting and tax carrying values the. Past simple and past participle of defer 3.

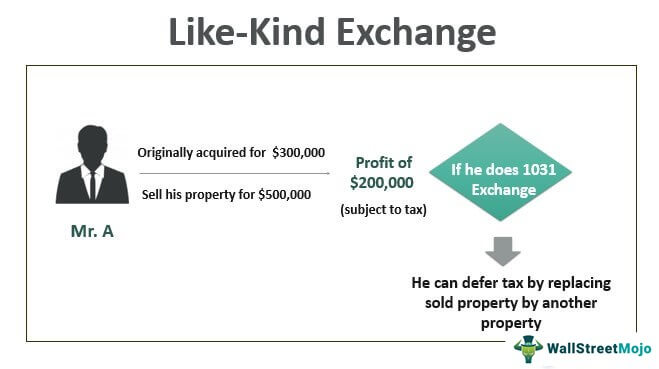

Like-kind exchanges -- when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or like-kind -- have long been permitted under the Internal Revenue Code. The purpose of this guidance. When deferred tax arises on assets acquired in a business combination whether the tax rate to be applied is that of the acquiree or acquirer.

Section 10 is amended to include a tax registration obligation for NRCs that supply taxable goods and services to Nigeria. Under the Tax Cuts and Jobs Act Section 1031 now applies only to exchanges of real property. See Regulation sections 11031a-1 11031a-3 and 11031k-1.

When the QOF liquidated the deferral period ended. Such a liability. The term ad valorem is Latin for according to value which means that it is flexible and depends on the assessed value of an asset product or serviceAn ad valorem tax is charged by state and municipal governments and is based on the assessed value of a product or propertyThe most common ad valorem tax is the property tax.

Tax collection agreements enable different. Income is money that an individual or business receives in exchange for providing a good or service or through investing capital. Call 800-829-3676 to order prior-year forms and instructions.

People aged 65 and. Noun a charge usually of money imposed by authority on persons or property for public purposes. The Section 1035 exchange is a tax-free exchange of an existing annuity contract or life insurance contract for a new one.

Get 247 customer support help when you place a homework help service order with us. NW IR-6526 Washington DC 20224. Where We Are a Service Provider.

Deferred Tax Liability. What is Ad Valorem Tax. No deduction shall be allowed under subsection a for any payment made directly or indirectly to an official or employee of any government or of any agency or instrumentality of any government if the payment constitutes an illegal bribe or kickback or if the payment is to an official or employee of a foreign government the payment is unlawful under the Foreign Corrupt.

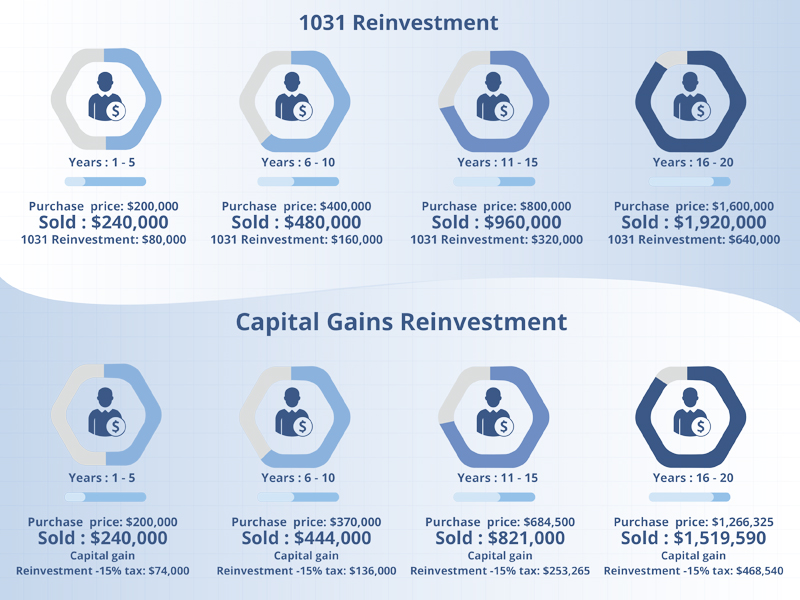

A tax deferred exchange that allows for the disposal of an asset and the acquisition of another similar asset without generating a tax liability from the sale of the first. For example if a business tax for the coming tax period is recognized to be 1500 then the balance sheet will reflect a tax payable amount of 1500 which needs to be paid by its due date. 308 to provide that the safe harbor of Rev.

Past simple and past participle of defer 2. Our Customers are organizations such as federal state local tribal or other municipal government agencies including administrative agencies departments and offices thereof private businesses and educational institutions including without limitation K-12 schools colleges universities and vocational schools who. A like-kind exchange under United States tax law also known as a 1031 exchange is a transaction or series of transactions that allows for the disposal of an asset and the acquisition of another replacement asset without generating a current tax liability from the sale of the first assetA like-kind exchange can involve the exchange of one business for another business.

Go to IRSgovOrderForms to order current forms instructions and publications. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. In order for the new contract to qualify as a.

You must include the deferred gain in the taxable year during which your QOF liquidated. A 1031 exchange is a tax break. The former provision appeared to be applicable to only taxable services.

Income is used to fund day-to-day expenditures. The provision of deferred tax on unrealised intra-group profits eliminated on. Deferred income tax liability on the other hand is an unpaid tax liability upon which payment is deferred until a future tax year.

11 This guidance is to help financial institutions their advisers and Canada Revenue Agency CRA officials with the due diligence and reporting obligations relating to the Canada-United States Enhanced Tax Information Exchange Agreement hereinafter referred to as the Agreement. Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada and of the governments of the Provinces of CanadaIn the fiscal year ending 31 March 2018 the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes. Prior to the Tax Reform Act of 1969 oil and gas production payments were treated as economic interests in oil and gas.

Dont resubmit requests youve already sent us. This procedure modifies Rev. You can get forms.

When deferred tax is recognised in a business combination whether this leads to an immediate impairment of goodwill.

Like Kind Exchanges Of Real Property Journal Of Accountancy

What Is A 1031 Tax Deferred Exchange Kiplinger

Are You Eligible For A 1031 Exchange

:max_bytes(150000):strip_icc():gifv()/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

What Is A 1031 Exchange Asset Preservation Inc

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

What Is The Benefit Of Tax Deferred Growth Great American Insurance

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Like Kind Exchange Meaning Rules How Does 1031 Works

1031 Tax Deferred Exchange Explained Ligris

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

Financing Archives Norada Real Estate Investments

1031 Exchange When Selling A Business

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

Tax Deferral How Do Tax Deferred Products Work

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules